The Illusion of Control: How Sui's Validators Paint a Decentralized Veneer

They tell you the community runs things. That anyone can be a validator. That you have a vote. But when you trace the mechanics, the money, and the hardware — it’s clear you’re not sitting at the table. You’re just watching through the window.

Imagine being told you can vote for your leaders — but only after the party picked all the candidates, set the rules, and funded the entire campaign. Sure, your vote counts… but only within the choices they’ve already approved.

That’s what decentralization looks like on Sui.

They tell you the community runs things. That anyone can be a validator. That you have a vote. But when you trace the mechanics, the money, and the hardware — it’s clear you’re not sitting at the table. You’re just watching through the window.

Let me explain.

What is DPoS, Really?

Sui uses something called Delegated Proof of Stake (DPoS). On the surface, this means that instead of everyone validating transactions directly, token holders get to delegate their tokens to professional validators. These validators then process the transactions, earn rewards, and share a cut with the delegators.

Sounds fair, right?

But here’s the catch: not just anyone can become a validator.

The Cost to Play

Originally, Sui required validators to stake 30 million SUI tokens. At launch, SUI traded at around $1.33, which means you needed nearly $40 million just to sit at the table.

Even after introducing SIP-39, which reduced the minimum to 2.4 million SUI, that’s still over $8.7 million at today’s prices. That’s not permissionless access. That’s an elite club.

And don’t forget the hardware:

24-core CPU

128GB ECC RAM

4TB NVMe SSD

Redundant power, server racks, data center hosting

This isn’t you setting up a node in your bedroom. This is enterprise-grade infrastructure.

Who Are These Validators?

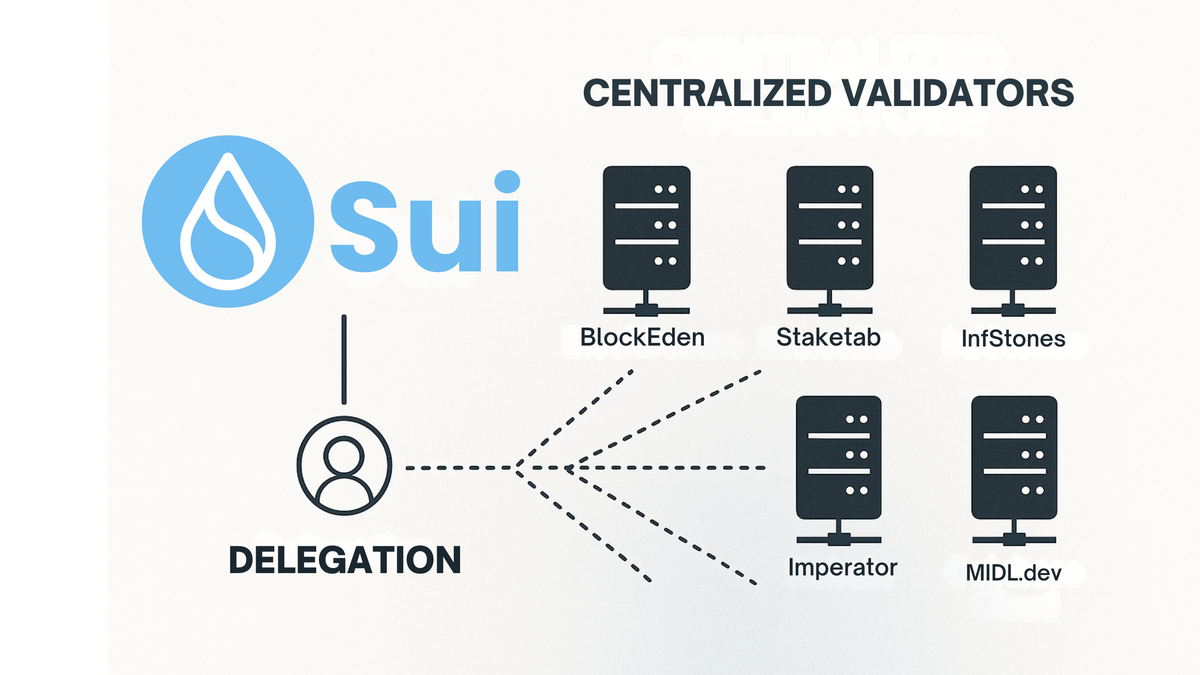

Let’s talk about who actually runs the show. Validators include entities like:

Imperator

Staketab

BlockEden.xyz

InfStones

MIDL.dev

These aren’t community collectives. They’re professional validator farms. Most of them operate across multiple chains, and many run dozens of validators at once.

So when you hear that "validators coordinated to freeze funds," it wasn’t thousands of independent actors linking arms for the greater good. It was likely a handful of centralized entities with the voting power to act as judge, jury, and executioner.

The Sui Foundation's Hand

To top it off, the Sui Foundation actively delegates its own tokens across the validator set. It claims this is to promote decentralization. In reality, it means the foundation has enormous influence over who gets into the validator set and who stays there.

So let’s recap:

The barrier to entry is millions of dollars.

The infrastructure is industrial-grade.

The validator pool is dominated by institutions.

The foundation holds the power to shape the outcome.

That’s not decentralization. That’s centralization dressed up in validator cosplay.

Analogy Time: Democracy or Boardroom?

Imagine if you could vote for your country's leaders, but only billionaires were allowed to run. And only if they had access to private infrastructure, pre-approval from the ruling foundation, and existing influence on multiple continents.

Would you still call that a democracy?

Because that’s what Sui is offering: the illusion of choice.

Why It Matters

In real DeFi, code is law. Immutable, permissionless, and unchangeable. Once you start injecting "community governance" backed by validators with massive influence and economic power, you’re not building trustless systems.

You’re rebuilding the same systems we were trying to escape from.

And if you ever wondered why protocols like PulseChain, HEX, and PulseX matter, it’s because they never relied on validator votes, foundation discretion, or social consensus to keep the code running.

They just launched. And they just work.

No committees. No freeze buttons. No reruns of the legacy model.

Just pure code.

And maybe that’s what scares them. That it’s not chaos they fear — it’s the absence of a master. Because when no one is in control, the only thing left… is you.

~Veritya Thalassa